Compare covers based on

Cover for:

Level of cover:

Specific cover for Hospital:

Specific cover for Extras:

Waiting periods and annual limits may apply.

‡ We pay limited benefits for Restricted services. This means that if you choose to be treated in a private hospital the benefits we pay will not cover all hospital costs and are likely to result in significant out-of-pocket expenses. For Restricted services in a Public hospital we will pay minimum shared room benefits.

^ Waiting period applies. For ambulance attendance or transportation to a hospital where immediate medical attention is required and your condition is such that you couldn't be transported any other way. TAS and QLD have State schemes that provide ambulance services for residents of those States.

= Eligible members on Medibank extras (excluding Healthy Living Extras and Gold Ultra Health) can claim a maximum of two 100% back dental check-ups per member, per year at a Members’ Choice Advantage provider (including bitewing x-rays where clinically required). For members on eligible extras, the first two check-ups do not count towards your annual limit. Members with Healthy Living Extras can get 100% back on one dental check-up each year at a Members’ Choice Advantage provider (including up to two bitewing x-rays, where clinically required) or at a Members’ Choice provider (excluding x-rays). Members with Gold Ultra Health can get 100% back on up to three dental check-ups at a Members’ Choice or Members’ Choice Advantage provider. Members’ Choice and Members’ Choice Advantage providers are not available in all areas. Two month waiting period applies. Some products may have other dental benefits, check your cover summary for details.

# Medibank has Members' Choice providers for these services. Not available in all areas.

~ Some items and services may require a Referral Letter and may have a benefit replacement period. Please see the Cover Summary or Member Guide for more information.

+ For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months of the Accident occurring. Excludes Private Emergency Department Benefit, hospital bonus, claims covered by third parties and our Private Room Promise. Out-of-pocket costs may apply. For Gold hospital covers, Accident Cover Boost is not required because all clinical categories are Included, regardless of whether or not the treatment is required as a result of an Accident.

> We'll pay a benefit up to an annual limit per membership towards any admission fee ("facility fee") charged by the Private Hospital for patients attending a Private Accident and Emergency Department. The fee amount varies by Private Hospital and does not include medical and other charges (such as charges for diagnostic imaging or pathology), so out of pocket expenses may still apply. Only available at Private Hospitals with an Accident and Emergency Department. Members will need to submit a claim to receive the benefit and may have to pay upfront. Two month waiting period applies.

Benefits of Medibank singles cover

100% back on dental check ups twice a year on eligible extras1

With eligible extras cover you get 100% back on up to two check-ups each year at a Members' Choice Advantage dentist (including bitewing x-rays where clinically required).¹

Accident Cover Boost

If you have an Accident, you’ll have access to all clinical categories included in Gold level hospital cover, no matter what level of hospital cover you have, thanks to our Accident Cover Boost.2

One of the largest health provider networks in Australia

We'll help you make the most of your cover, with access to more than 470 Members' Choice hospitals and more than 17,000 Members' Choice extras provider locations.

Hospital & Extras offer - Want up to 12 weeks free and up to $500 in gift cards?

Join and maintain eligible Bronze hospital and extras cover or above and you could get up to 12 weeks free plus 50,000 Live Better points (couples and families) or 25,000 Live Better points (singles and single parents) to redeem on rewards like gift cards. We'll also waive 2&6 month waiting periods on extras. Offer ends 9 April 2025. Use promo code: 12WEEKSPLUS. New members only.€

Get a quote Find out more

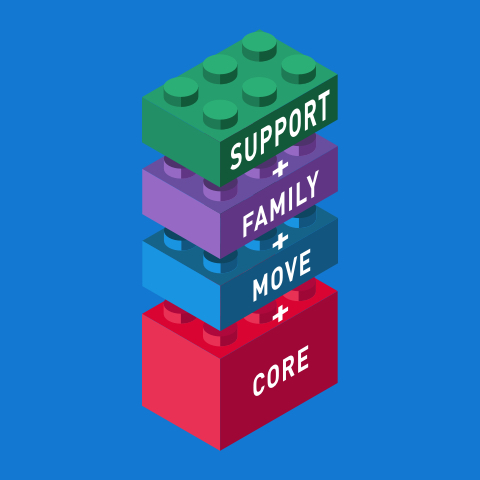

Want greater flexibility & choice with your cover?

Then how about building your own extras cover with Medibank's new My Choice Extras?

€ For new members on new memberships who join and start eligible combined Bronze hospital and extras cover or above from 5 March – 9 April 2025 and who have not held Medibank health cover in previous 60 days (unless they are dependents coming off their parent’s cover). Must quote promo code 12WEEKSPLUS and set up direct debit when joining. Must have Australian residence. Excludes Basic cover, Corporate covers, Hospital only cover, Extras only cover, Accident Cover, Overseas Visitors Health Cover, Overseas Workers Health Cover, Overseas Students Health Cover (OSHC), Ambulance Cover, ahm covers, and other selected covers. Not available to Medibank employees. Not available with any other offer. Medibank reserves the right to amend these Terms and Conditions from time to time.

Weeks free terms: Must remain up-to-date with premium payments and hold eligible cover for 42 consecutive days from the policy start date to get initial 6 weeks free, and for 15 consecutive months to receive subsequent 6 weeks free. The initial 6 weeks free will be applied at the next billing cycle after you have held eligible cover for 42 consecutive days. The subsequent 6 weeks free will be applied at the next billing cycle after you have held eligible cover for 15 months. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Discounted amount to reflect level of eligible cover at time of discount.

2&6 month waits waived on extras terms: 2&6 month waiting periods on extras waived. Other waiting periods apply (including 12 months on some dental services). Annual limits apply. If you're switching from another fund and you’ve used any of your current limits (at that fund), that will count towards your annual limits with us. If you've reached your limits at your previous fund you may not be able to claim straight away on extras.

Live Better rewards points terms: Must maintain direct debit and hold eligible product for 42 consecutive days from the policy start date to receive Live Better rewards points. The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank app. Policyholder will need to have registered a My Medibank account, sign up to Live Better via the My Medibank app and track a Live Better activity within 42 consecutive days from the policy start date. Must be 16 years or over to register for Medibank Live Better. Live Better rewards points could take up to 10 weeks from the policy start date to be loaded to the policyholder’s Live Better account. Singles and single parents will receive 25,000 Live Better rewards points, and families and couples will receive 50,000 Live Better rewards points.

Live Better rewards terms: Must be a Medibank member with eligible hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Live Better via the My Medibank app to redeem rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/

1 Eligible members on Medibank extras (excluding Healthy Living Extras and Gold Ultra Health) can claim a maximum of two 100% back dental check-ups per member, per year at a Members’ Choice Advantage provider (including bitewing x-rays where clinically required). For members on eligible extras, the first two check-ups do not count towards your annual limit. Members with Healthy Living Extras can get 100% back on one dental check-up each year at a Members’ Choice Advantage provider (including up to two bitewing x-rays, where clinically required) or at a Members’ Choice provider (excluding x-rays). Members with Gold Ultra Health can get 100% back on up to three dental check-ups at a Members’ Choice or Members’ Choice Advantage provider. Members’ Choice and Members’ Choice Advantage providers are not available in all areas. Two month waiting period applies. Some products may have other dental benefits, check your cover summary for details.

2 For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months of the Accident occurring. Excludes Private Emergency Department Benefit, hospital bonus, claims covered by third parties and our Private Room Promise. Out-of-pocket costs may apply. For Gold hospital covers, Accident Cover Boost is not required because all clinical categories are Included, regardless of whether or not the treatment is required as a result of an Accident.