Jump to section: Cover options | Why choose Medibank Travel Insurance | NZ travel advice | Snow and Ski cover | Frequently asked questions

Travel insurance for New Zealand holidays

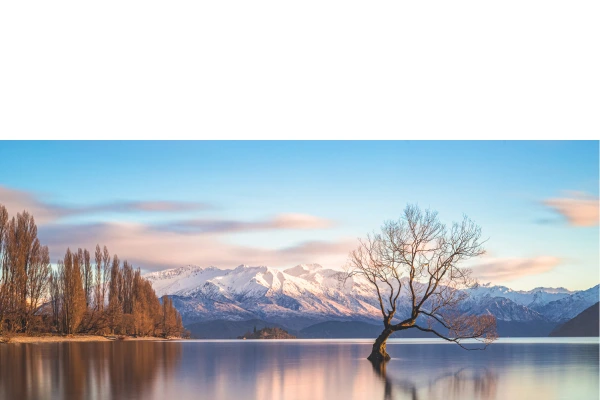

From the mountain peaks of Mount Cook to the beaches of Northland, New Zealand can really have it all. You won't be short of things to do, and getting travel insurance can be a great way to help protect your trip.

Travel insurance can help protect you financially when something goes wrong. That is why the Australian Government recommends travellers getting comprehensive travel insurance before travelling to New Zealand. You can also add additional covers for activities like multi-night cruises, skiing or snowboarding.

International Comprehensive Plan

Travel cover for overseas medical and dental emergencies, plus inclusions for unforeseen cancellations and valuables like laptops and cameras.

- 24-hour emergency assistance

- 21 day cooling off period1

- Overseas medical/dental expenses

- COVID-19 benefits

- Up to $25k luggage cover2

- Rental car insurance excess

- Cancellation & amendment fees3

- Cover for missed connections4

International Annual Multi-Trip

Annual Multi Trip Plan includes the same benefits as International Comprehensive Plan for multiple trips (up to the duration specified) within 12 months.5

- 24-hour emergency assistance

- 21 day cooling off period1

- Overseas medical/dental expenses

- COVID-19 benefits

- Up to $25k luggage cover2

- Rental car insurance excess

- Cancellation & amendment fees3

- Cover for missed connections4

International Medical Only Plan

Our basic international travel insurance provides cover for Overseas Medical and Hospital Expenses that occur whilst you're travelling.

- 24-hour emergency assistance

- 21 day cooling off period1

- Overseas medical/dental expenses

- COVID-19 benefits

- Cover for luggage

- Rental car insurance excess

- Cancellation & amendment fees

- Cover for missed connections

All Medibank Travel Insurance options for New Zealand include $Unlimited hospital accident and evacuation expense cover6 and 24/7 Emergency assistance. Depending on which plan you choose, you could also have cover for cancellations, luggages, rental car insurance excess, and more.

$Unlimited cancellation costs on an International Comprehensive Plan

What happens if you have to cancel your overseas adventure due to certain unforeseen circumstances like a family emergency? With Medibank's Comprehensive Travel Insurance plans, you'll have cover for the unused portion of accommodation and other prepaid costs.3

24/7 Emergency assistance

If there's an emergency, our dedicated team of doctors, nurses, travel consultants and case managers are ready to help you 24/7. We can help find appropriate medical treatment, organise medical evacuation, replace lost travel documents, change travel plans, and more. Every Medibank Travel Insurance policy comes with this service.

Rental car insurance excess

A fan of road trips? No worries. If your rental vehicle is in an accident, damaged or stolen during your NZ trip, Medbank Comprehensive Travel Insurance will provide cover up to $10,000 to help you pay for the rental car insurance excess.

Luggage insurance and personal effects cover

Help protect your valuables, with cover for lost, stolen or damaged items. Get up to $25,000 cover on our International Comprehensive Plan.2

Multi-award winning travel insurance

We're proud to be winners of Mozo's Experts Choice Awards in 2022 & 2023 and Mozo's People's Choice Award in 2024.

New Zealand is the ideal getaway for some Aussie travellers, with iconic cities like Auckland and Christchurch, a scenic capital in Wellington, or the adventure hub - Queenstown. With such a range of scenery and activities, there can be some risks for visitors. These can include natural disasters like earthquakes and tsunamis, or if you plan to participate in some adventure activities, such as white water rafting, bungee jumping and jetboating. Here are some helpful tips for Aussies travelling to New Zealand.

When is the best time to visit New Zealand?

New Zealand can be your travel destination for all seasons, depending on what experience you're seeking.

- Summer (December - February) is usually the peak travel season in New Zealand. With long and sunny days, it's ideal for outdoor activities like hiking and kayaking. But, the cost for flights, accommodation and car rental can be higher.

- Autumn (March - May) could be the perfect time to see some stunning autumn colours with fewer crowds and milder temperatures than in the summer. If you enjoy photography, or hiking in the temperate climate, Autumn can be a great time to visit.

- Winter (June - August) in New Zealand can be a wonderland for snow sports lovers, with its unique mountainous terrain and well-developed tourism industry. (Find out more about snow sports cover.) For other travellers, you can take the train journey through the Southern Alps, explore the glacier and the winter scenery, or soak in the hot springs. You can also have a magical stargazing experience or even see the Southern lights.

- Spring (September - November) is the time when nature bursts into life in New Zealand, which offers an immersive experience in New Zealand's diverse landscape. Read more on some top spring activities.

Why do I need travel insurance to travel to New Zealand?

Travel insurance can help protect your trip when the unexpected happens. Depending on the cover you choose, it can include:

- Medical costs: According to Smartraveller, even though New Zealand and Australia have a reciprocal healthcare agreement, the Australian Government won't pay for all overseas medical costs, like medical evacuation. Without travel insurance, you may have to pay for costly medical care up-front.

- Adventure activities: Most people enjoy adventure activities safely in NZ. However, these activities carry risks and several serious accidents have occurred before (Smartraveller). Some adventure activities are automatically included in Medibank Comprehensive Insurance for New Zealand. Participation in these activities is subject to the ordinary terms of cover and general exclusions. For other activites such as ski, additional cover is required. Read the PDS for more details.

- Severe weather and natural disasters: New Zealand's unique geography creates the breathtakingly-beautiful landscape, but also causes the weather conditions change quickly. Natural disasters such as earthquakes, tsunamis, volcanic activity can occur (Smartraveller). Comprehensive Travel Insurance can help cover for emergency accommodation and transport expenses if a natural disaster happens, provided you purchase your policy before the risk has been announced. View Medibank travel alert.

Planning for snow? Consider additional ski insurance for New Zealand

A winter holiday to Wanaka or Mount Cook can be an amazing experience, but being on the slopes can also present increased chance of injury. You can purchase cover for snow skiing, snowboarding, snowmobiling for an additional premium. This is done during the quote process.

Make sure you know what is and isn’t covered by your policy, even if you pay the extra premium you will not be covered if:

- You are skiing or snowboarding outside the resort boundaries or in an out of bounds area within the resort

- You are racing

- You are participating in a professional capacity.

Things you should know

1 21 day cooling off period applies if you cancel your policy within 21 days of purchase provided you have not made a claim or travelled on the policy.

2 Item limits and sub-limits apply. See the Combined FSG/PDS for terms, conditions and more information.

3 Conditions and sub-limits apply. See the Combined FSG/PDS for more information.

4 Limits apply. See the Combined FSG/PDS for terms, conditions, exclusions and more information.

5 Cover is limited to a maximum duration of up to 30, 45 or 60 days for international trips or 15 or 30 days on domestic trips depending on the duration choice you make.

6 Medical cover will not exceed 12 months from the onset of the illness or injury. Medical evacuation cover subject to claim approval.

Limits, sub-limits, exclusions and conditions apply. This is general advice only. Medibank Private Limited, ABN 47 080 890 259, an Authorised Representative, AR 286089, of Travel Insurance Partners Pty Limited, ABN 73 144 049 230 AFSL 360138 arranges the insurance on behalf of the insurer. The insurer is Zurich Australian Insurance Limited ABN 13 000 296 640, AFSL 232507. Please consider your own needs and the Combined FSG/PDS to decide if this product is right for you. For information on the Target Market and Target Market Determinations, visit medibank.com.au/travel-insurance/help/