Private health insurance rebate details will automatically be uploaded to the Australian Taxation Office.

If you do your tax return online or have an accountant, you don't need a copy of your tax statement.

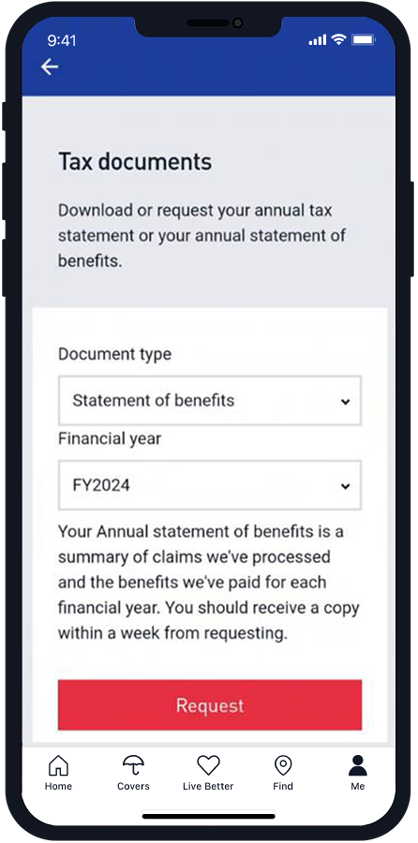

If you do a paper tax return, or would still like to view your statement, you can download it securely in My Medibank from 15 July. For instructions see below.

If you are unsure whether you need your tax statement to complete your tax return, for 1 July 2023 to 30 June 2024, please speak with your accountant or contact the Australian Taxation Office on 132 861 or visit ato.gov.au.

Accessing your tax statement

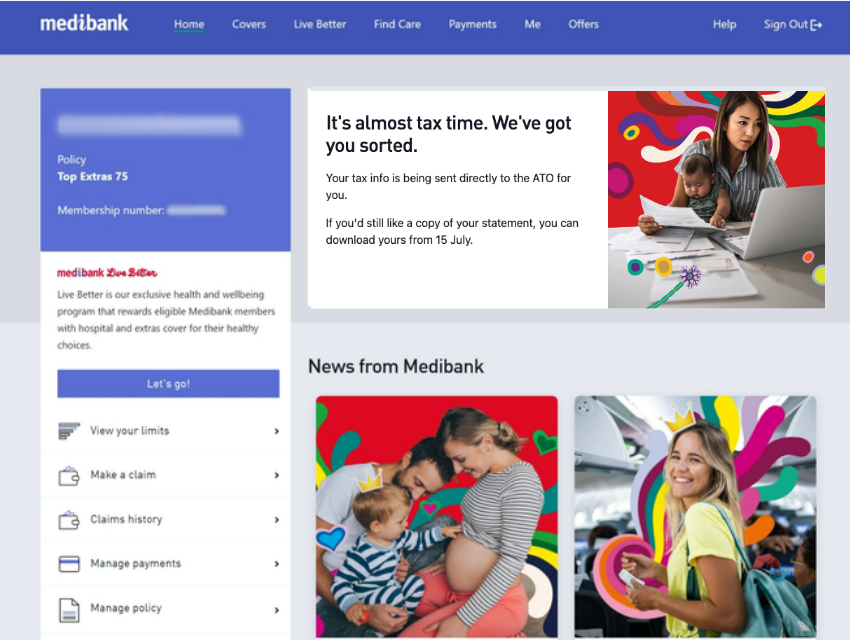

View and download your statement online

If you don't have a My Medibank web login, you can register here.

To make tax time as simple and straightforward as possible, we’ve put together a “how to read guide” that shows you where all the information goes on your tax return. Download guide.

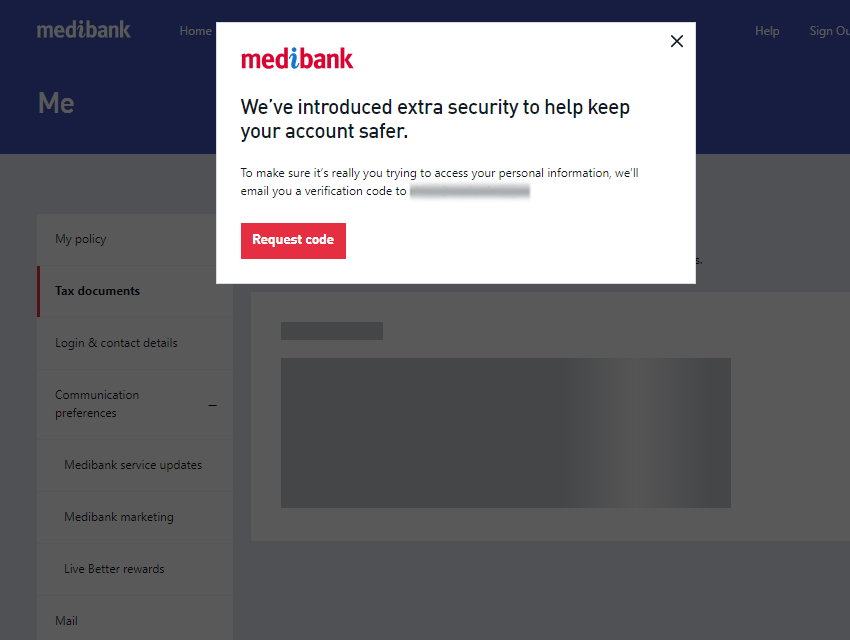

How to view and download your statement on the web

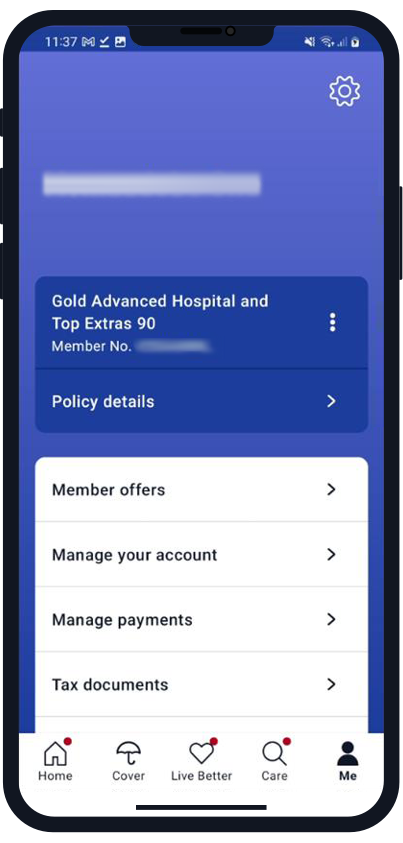

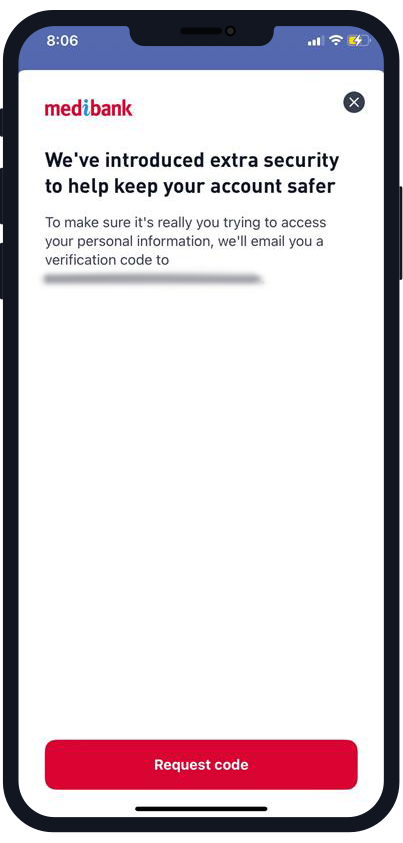

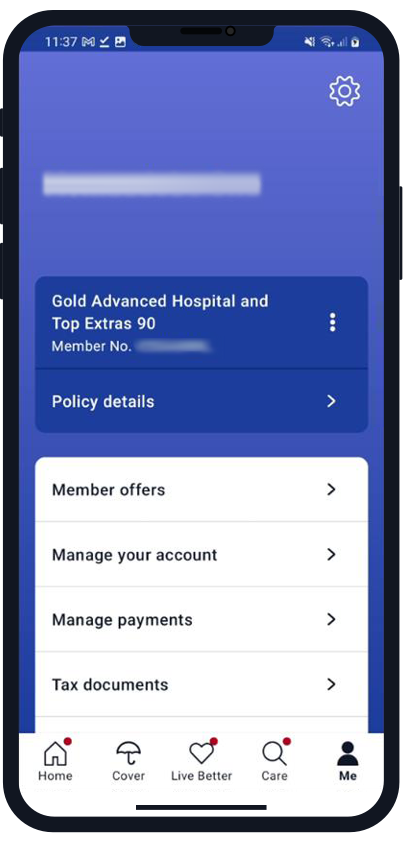

How to view and download your statement on the app

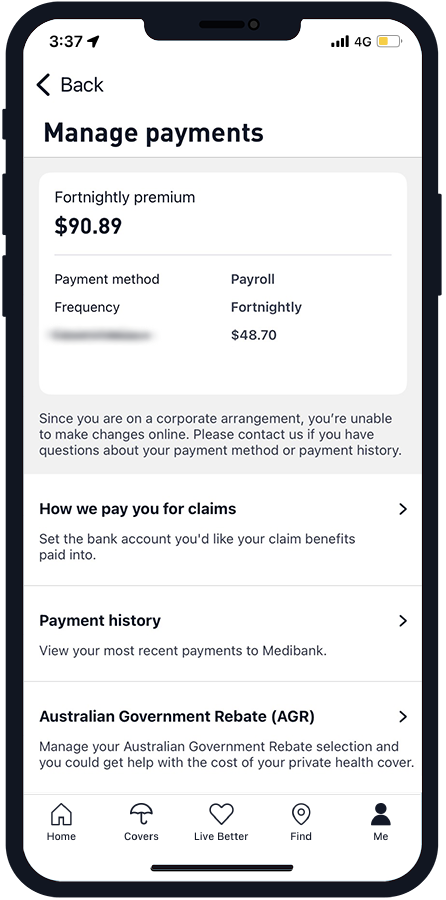

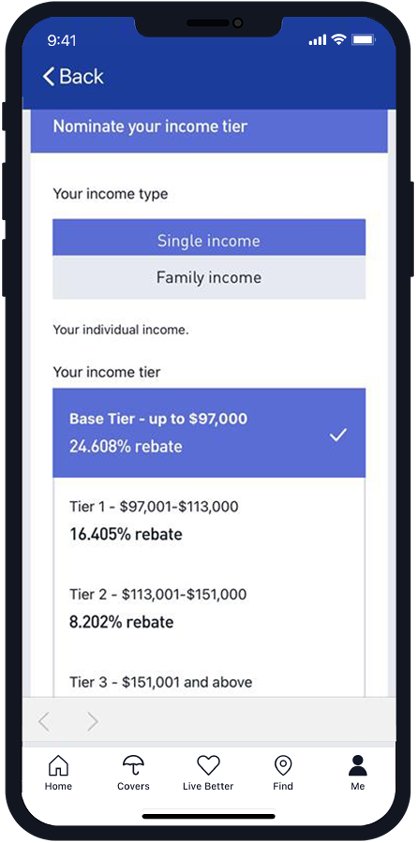

What is your Australian Government Rebate and how to update it

The government may offer a rebate on health cover premiums known as the Australian Government Rebate (AGR). Read more about the AGR and how it's calculated.

If you want to check you’re on the correct AGR income tier or change your income tier, you can do this on My Medibank. See how to instructions below.

How to view or change your Australian Government Rebate Income tier on the web

How to view or change your Australian Government Rebate Income tier on the app

Overseas health cover

The Australian Government Rebate (AGR) doesn’t apply for overseas health cover, nor does it provide exemption from the Medicare Levy Surcharge (MLS). You do not need this information for your tax return.

Want to know more?

If there are any other questions you’d like answered, go to medibank.com.au/contact-us.